Hi, I need help from someone with economical knowledge.

I know that similar questions have been discussed before, but my question is related to an scenario I'm thinking about.

I'm starting to work in a scenario whose main POD is a different outcome in the castilian War of the Comunidades. Due to the importance of Castille in the construction of the Habsburg empire, a redifiniton of the relations between the souvereign (Charles V in this case) and his castilian subjects, plus the socio-economical changes that a triumphant urban and commoner revolt (revolution?) would produce in the castilian heartlands, there would be widespread butterflies, and regarding that matter, important differences in the colonization and exploitation of the Americas. Furthermore, without the implication in the imperial affairs and Italy seen in OTL, Castille* wouldn't become OTL credit beggar and wouldn't need to manipulate his currency at the same extent than in OTL (I guess), thus a more important part of the american silver and gold would stay in the iberian kingdom instead flowing to the credit lenders of Italy, Germany and the Low Countries (and Seville).

So, the key points are:

1. A slowed castilian consolidation in the Americas and probably a slighty different model of colonization, though I should think more about the latter.

2. Less of those yet lessened american resources flowing out of Castille to the european financial markets. Therefore, the spanish role as "transmission belt" of the american surplus to the european economical centers will be greatly mitigated.

Of course, a slowed castilian expansion in the New World could be profited in the medium term by other atlantic powers, but by 1520 I think that Castille was yet in postion to finally grab what would be the core of the overseas empire in OTL (They were firmly established in the Antilles, the Aztec empire was being conquered by Cortés at the time and Magellan was in the sea, though a castilian conquest of the Philipines in TTL is arguable), so the competition would be only in the peripherial regions. And, the most important thing to my question, the main silver sources would be still under castilian control, so other powers couldn't exploit them. However, the conquest of the Tawantinsuyu may or may not be delayed (I'd also appreciate suggerences about this. I assume a diferent conquest if it's delayed enough due to the development of the political conflicts inside the andean empire). I have concluded that the only way to make possible a comunero success is through a longer conflict than in OTL, followed by a period of certain political inestability and nasty repression, and that also should affect and delay the consolditaion and organization of the american conquests.

I would like to be more precise, but the idea is still maturing, so I can't figure exact numbers and dates. But let's say that the the precious metals inflow from the Americas is delayed. So, let's say that the exploitation of the Potosí and other peruvian mines is delayed about 25 years. For Zacatecas and other mexican mines, let's say 15 years. In the case of Potosí anything is possible, taking into account that it was discovered thanks to a lot of luck, and besides that the date of the conquest of the Inca empire obviously would be a key fact to start speculating. Regarding Zacatecas and San Luís Potosí (which obviously will stay San Luis Mesquitique in TTL), I assume that political conflictivity in Castille slows the affluence of colonists and the exploration of the territory, so I think that 15 years are a feasible margin to work with. I know that these are very arbitrary choices.

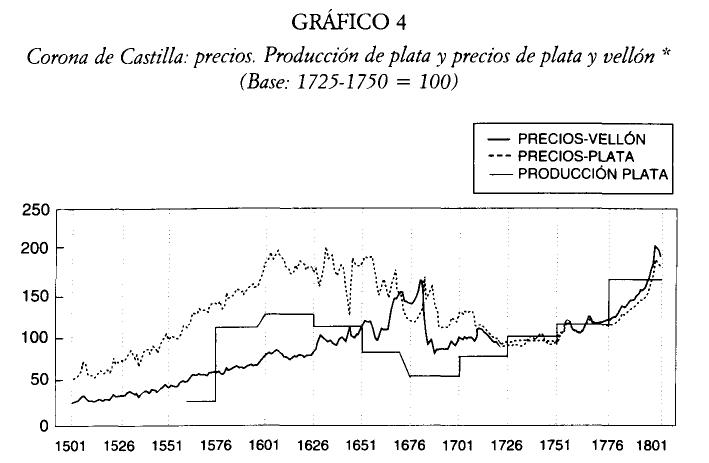

I have attached the famous Hamilton's table about the correlation between production of Silver and prices in Castile as reference (OTL)

Now, to take into account in the alternative scenario:

A) With the assumed dates, Potosí would start its production by 1570. Oruro started its production in 1601 in OTL. I don't know if the date would be delayed in TTL, but to make it easy, let's assume that the curve of alto-peruvian production is only delayed in time but doesn't change it's shape. Zacatecas would start its production about 1562, and San Luís Mesquitique about 1610.

C) In OTL, during its peak, peruvian production was highly superior to the mexican one, reaching the 90% of the silver production in the spanish empire. It shouldn't be different in TTL with the obvious exception of the dates of production.

D) The most problematic element in the equation, to my understanding: I guess that with the mentioned problems in the metropoli and the lower affluence of colonists, the silver production would not only be delayed but also decreased, at least during its first steps. Though the manpower was composed mainly by indigineous people, the investors were castilian particulars and the castilian crown. But I don't know how stimate the effect of these changes.

That said, my questions:

What are the effects in the development of the early capitalism? It's delayed? It's only delayed or can we espect major changes? And the same regarding inflation. If the growth of the silver inflow is decreased enough (see D) can the european economies suffer less stress and adapt differently to the new situation? And the most important, what am I missing?

On the other hand, we have China. It's stimated that between 1/3 and 1/2 (my sources diverge) of the american silver didn't flowed to Europe but to China. In the mid XVth century, traders from southern China adopted a sort of silver standard to fight their own problems with the hyper-inflation of the chinese paper money. As consequence, the chinese demand of Silver skyrocketed and latter attracted the interest of the europeans, who exchanged it for gold, silk, spices and other goods. The Manilla Galleon played a key role in these exchanges for the spanish empire. With a delayed explosion of the american silver production, as we say, and probably a more dificult position for Castille in the Pacific, what could be the effects in the chinese affairs? If I'm not wrong, the decreasing in the supply of silver in the early XVIIth century played an important role in the fall of the Ming dinasty. A latter explosion in the american production would accelerate their fall? Or, on the contrary, could save them? How do you think the early asian-european trade would be affected? Can the portuguese enlarge their profits in the asian markets in this scenario?

*The spanish personal union as we know it probably will be disolved in TTL.

Thanks for your attention.

Translation of the graphic's key: Precios-Vellón = Prices in Billon

Precios-Plata = Prices in silver

Producción plata = Silver production

I know that similar questions have been discussed before, but my question is related to an scenario I'm thinking about.

I'm starting to work in a scenario whose main POD is a different outcome in the castilian War of the Comunidades. Due to the importance of Castille in the construction of the Habsburg empire, a redifiniton of the relations between the souvereign (Charles V in this case) and his castilian subjects, plus the socio-economical changes that a triumphant urban and commoner revolt (revolution?) would produce in the castilian heartlands, there would be widespread butterflies, and regarding that matter, important differences in the colonization and exploitation of the Americas. Furthermore, without the implication in the imperial affairs and Italy seen in OTL, Castille* wouldn't become OTL credit beggar and wouldn't need to manipulate his currency at the same extent than in OTL (I guess), thus a more important part of the american silver and gold would stay in the iberian kingdom instead flowing to the credit lenders of Italy, Germany and the Low Countries (and Seville).

So, the key points are:

1. A slowed castilian consolidation in the Americas and probably a slighty different model of colonization, though I should think more about the latter.

2. Less of those yet lessened american resources flowing out of Castille to the european financial markets. Therefore, the spanish role as "transmission belt" of the american surplus to the european economical centers will be greatly mitigated.

Of course, a slowed castilian expansion in the New World could be profited in the medium term by other atlantic powers, but by 1520 I think that Castille was yet in postion to finally grab what would be the core of the overseas empire in OTL (They were firmly established in the Antilles, the Aztec empire was being conquered by Cortés at the time and Magellan was in the sea, though a castilian conquest of the Philipines in TTL is arguable), so the competition would be only in the peripherial regions. And, the most important thing to my question, the main silver sources would be still under castilian control, so other powers couldn't exploit them. However, the conquest of the Tawantinsuyu may or may not be delayed (I'd also appreciate suggerences about this. I assume a diferent conquest if it's delayed enough due to the development of the political conflicts inside the andean empire). I have concluded that the only way to make possible a comunero success is through a longer conflict than in OTL, followed by a period of certain political inestability and nasty repression, and that also should affect and delay the consolditaion and organization of the american conquests.

I would like to be more precise, but the idea is still maturing, so I can't figure exact numbers and dates. But let's say that the the precious metals inflow from the Americas is delayed. So, let's say that the exploitation of the Potosí and other peruvian mines is delayed about 25 years. For Zacatecas and other mexican mines, let's say 15 years. In the case of Potosí anything is possible, taking into account that it was discovered thanks to a lot of luck, and besides that the date of the conquest of the Inca empire obviously would be a key fact to start speculating. Regarding Zacatecas and San Luís Potosí (which obviously will stay San Luis Mesquitique in TTL), I assume that political conflictivity in Castille slows the affluence of colonists and the exploration of the territory, so I think that 15 years are a feasible margin to work with. I know that these are very arbitrary choices.

I have attached the famous Hamilton's table about the correlation between production of Silver and prices in Castile as reference (OTL)

Now, to take into account in the alternative scenario:

A) With the assumed dates, Potosí would start its production by 1570. Oruro started its production in 1601 in OTL. I don't know if the date would be delayed in TTL, but to make it easy, let's assume that the curve of alto-peruvian production is only delayed in time but doesn't change it's shape. Zacatecas would start its production about 1562, and San Luís Mesquitique about 1610.

C) In OTL, during its peak, peruvian production was highly superior to the mexican one, reaching the 90% of the silver production in the spanish empire. It shouldn't be different in TTL with the obvious exception of the dates of production.

D) The most problematic element in the equation, to my understanding: I guess that with the mentioned problems in the metropoli and the lower affluence of colonists, the silver production would not only be delayed but also decreased, at least during its first steps. Though the manpower was composed mainly by indigineous people, the investors were castilian particulars and the castilian crown. But I don't know how stimate the effect of these changes.

That said, my questions:

What are the effects in the development of the early capitalism? It's delayed? It's only delayed or can we espect major changes? And the same regarding inflation. If the growth of the silver inflow is decreased enough (see D) can the european economies suffer less stress and adapt differently to the new situation? And the most important, what am I missing?

On the other hand, we have China. It's stimated that between 1/3 and 1/2 (my sources diverge) of the american silver didn't flowed to Europe but to China. In the mid XVth century, traders from southern China adopted a sort of silver standard to fight their own problems with the hyper-inflation of the chinese paper money. As consequence, the chinese demand of Silver skyrocketed and latter attracted the interest of the europeans, who exchanged it for gold, silk, spices and other goods. The Manilla Galleon played a key role in these exchanges for the spanish empire. With a delayed explosion of the american silver production, as we say, and probably a more dificult position for Castille in the Pacific, what could be the effects in the chinese affairs? If I'm not wrong, the decreasing in the supply of silver in the early XVIIth century played an important role in the fall of the Ming dinasty. A latter explosion in the american production would accelerate their fall? Or, on the contrary, could save them? How do you think the early asian-european trade would be affected? Can the portuguese enlarge their profits in the asian markets in this scenario?

*The spanish personal union as we know it probably will be disolved in TTL.

Thanks for your attention.

Translation of the graphic's key: Precios-Vellón = Prices in Billon

Precios-Plata = Prices in silver

Producción plata = Silver production