You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

WI: No 1980s Financialization

- Thread starter CountDVB

- Start date

And the Republicans in Congress, in the pay of the financial system's lobbyists, gutted the regulator, so there was nobody watching. Not to mention, the people doing it were incompetent to understand the fancy instruments that had been created, which nobody, including the people who'd invented them, understood.Regulating banks sounds great in theory, but you need to actually have someone to do the regulating.

Yet, after the '08 Crash, the same lobbyists still resist any regulation on derivatives.

And there was, & is, no penalty for the rating agencies lying about the products of the companies they're supposedly rating being complete garbage, which they routinely did before the '08 Crash--& still are.

Give me a break. Dodd-Frank was so watered down because Congress is in the pay of the lobbyists, who don't want regulations. Even after the '08 Crash. They'd rather rely on another taxpayer bailout. And the people in charge are going to give it to them, because they're in a conflict of interest: they want to work for the banks after they leave government, or because they come from those banks, or both. (You think Geitner's a hero? He went into Obama's Cabinet with a gigantic conflict of interest, & advocated a solution that essentially sold out homeowners & taxpayers, rather than using the power of the Fed, & USG, to wind up the failed banks in an orderly fashion, & failed to demand banks refi mortgages & demand banks change pay/bonus policies, then refused to take the effective action to help homeowners by buying up bad mortgages {which, as it turns out, is better than a bank bailout}. Why? He didn't want to hurt his friends, & he hoped to go back & join them when he was done in government. So the public got fucked, instead.)Look at the specifics of Dodd-Frank: even after everything we learned from 2008, it makes no attempt to directly regulate the financial instruments that did cause the recession or cause a similar one. In my opinion, the law - while certainly necessary - is almost crude in its construction.

Please. It was repealed as a result of lobbying by the financial industry & by an anti-regulation ideology.Which brings us to a crucial point: Glass Steagall (as mentioned in the article cited further down by the OP) wasn't repealed because of corruption or foolishness, it was repealed because it was obsolete and completely ineffective, like relying on laws made in the 20s to regulate modern vaccine production.

Edit:

Solutions? IDK. For a start, I'd say, get rid of the NOL deduction for anything but new equipment. That helped finance the wave of LBOs in the '80s.

Changing the tax laws so short-term gains (stock options, say) aren't attractive would be a good idea.

Taxing capital gains at 90% would be an excellent idea, IMO.

Last edited:

So without the wave wave deregulation, you’d think we’d get rid of NOL deductions or would they be just more restricted?And the Republicans in Congress, in the pay of the financial system's lobbyists, gutted the regulator, so there was nobody watching. Not to mention, the people doing it were incompetent to understand the fancy instruments that had been created, which nobody, including the people who'd invented them, understood.

Yet, after the '08 Crash, the same lobbyists still resist any regulation on derivatives.

And there was, & is, no penalty for the rating agencies lying about the products of the companies they're supposedly rating being complete garbage, which they routinely did before the '08 Crash--& still are.

Give me a break. Dodd-Frank was so watered down because Congress is in the pay of the lobbyists, who don't want regulations. Even after the '08 Crash. They'd rather rely on another taxpayer bailout. And the people in charge are going to give it to them, because they're in a conflict of interest: they want to work for the banks after they leave government, or because they come from those banks, or both. (You think Geitner's a hero? He went into Obama's Cabinet with a gigantic conflict of interest, & advocated a solution that essentially sold out homeowners & taxpayers, rather than using the power of the Fed, & USG, to wind up the failed banks in an orderly fashion, & failed to demand banks refi mortgages & demand banks change pay/bonus policies, then refused to take the effective action to help homeowners by buying up bad mortgages {which, as it turns out, is better than a bank bailout}. Why? He didn't want to hurt his friends, & he hoped to go back & join them when he was done in government. So the public got fucked, instead.)

Please. It was repealed as a result of lobbying by the financial industry & by an anti-regulation ideology.

Edit:

Solutions? IDK. For a start, I'd say, get rid of the NOL deduction for anything but new equipment. That helped finance the wave of LBOs in the '80s.

Changing the tax laws so short-term gains (stock options, say) aren't attractive would be a good idea.

Taxing capital gains at 90% would be an excellent idea, IMO.

Tax reform would be interesting though wonder what could trigger it.

I guess as the economy moves more to finance, without the insane deregulation, wed see some increase of capital gains?

GeographyDude

Gone Fishin'

Maybe somewhat slower overall growth. But less erosion of U.S. middle income jobs.Another question is on the general state of the economy. We probabl won't have the Great Recession nor the savings/loan stuff though the DotCom Bubble burst will still happen. Would the economy just be somewhat stagnant or just low but steady growth if at all?

But maybe not slower. Economist Joseph Stiglitz has written and argued that income inequality hurts overall GDP growth. I think he’s argued that it hurts sooner and more than his fellow economists have estimated so far.

Last edited:

GeographyDude

Gone Fishin'

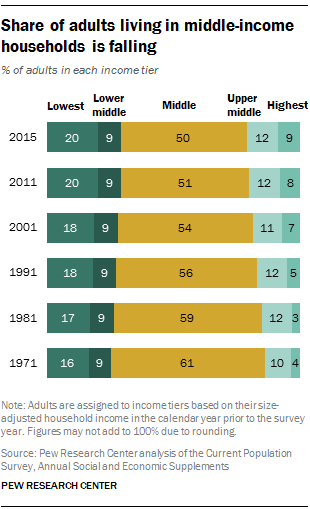

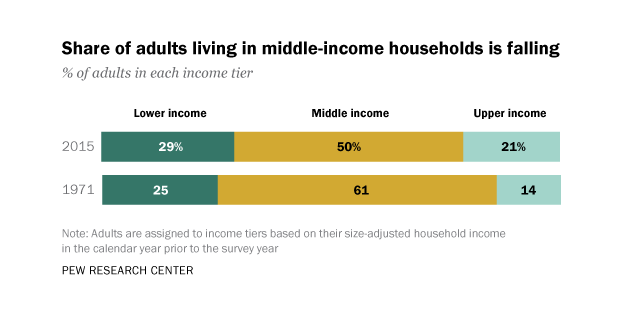

The American Middle Class Is Losing Ground

After more than four decades of serving as the nation's economic majority, the U.S. middle class is now matched in size by those in the economic tiers above and below it.

So, this very modest decline from 61% of U.S. adults having a middle income to 50% ? ? ?

And look, of those “squeezed out,” about 2/3’s have moved upward and only about 1/3 have moved downward. Might almost argue that in balance this is a good thing.

Except that it’s probably the single biggest contributing factor to political extremism since the time of Reagan, Newt Gingrich, the “Tea Party” in 2009. And to avoid current politics, let’s please stop around 2014 when ebola outbreaks were an issue in the Congressional mid-terms. Certainly a problem to be worked, but not hyped.

2014 is also when overall payroll recovered to its pre-Great Recession levels.

—————————

These middle-income numbers are based on yearly telephone surveys. And heck yeah, people fudge their income upward due to pride.

Last edited:

That was true in 1971 as well so that should have evened out.—————————

The above middle-income numbers are based on yearly telephone surveys. And heck yeah, people fudge their income upward due to pride.

GeographyDude

Gone Fishin'

Yes, conflict of interest is a major, substantial problem, and it’s both Democrats and Republicans. There are some current laws about a certain window before taking a job in the same field you regulated, and I’m sure proposals for even a longer window— But I’m not sure it’s near enough.. . . (You think Geitner's a hero? He went into Obama's Cabinet with a gigantic conflict of interest, & advocated a solution that essentially sold out homeowners & taxpayers, rather than using the power of the Fed, & USG, to wind up the failed banks in an orderly fashion, & failed to demand banks refi mortgages & demand banks change pay/bonus policies, . . .

As far as mortgage relief during a crisis, make it primary residence — as far as helping just regular homeowners and not investors — and cap it at a certain maximum tax credit, that kind of thing.

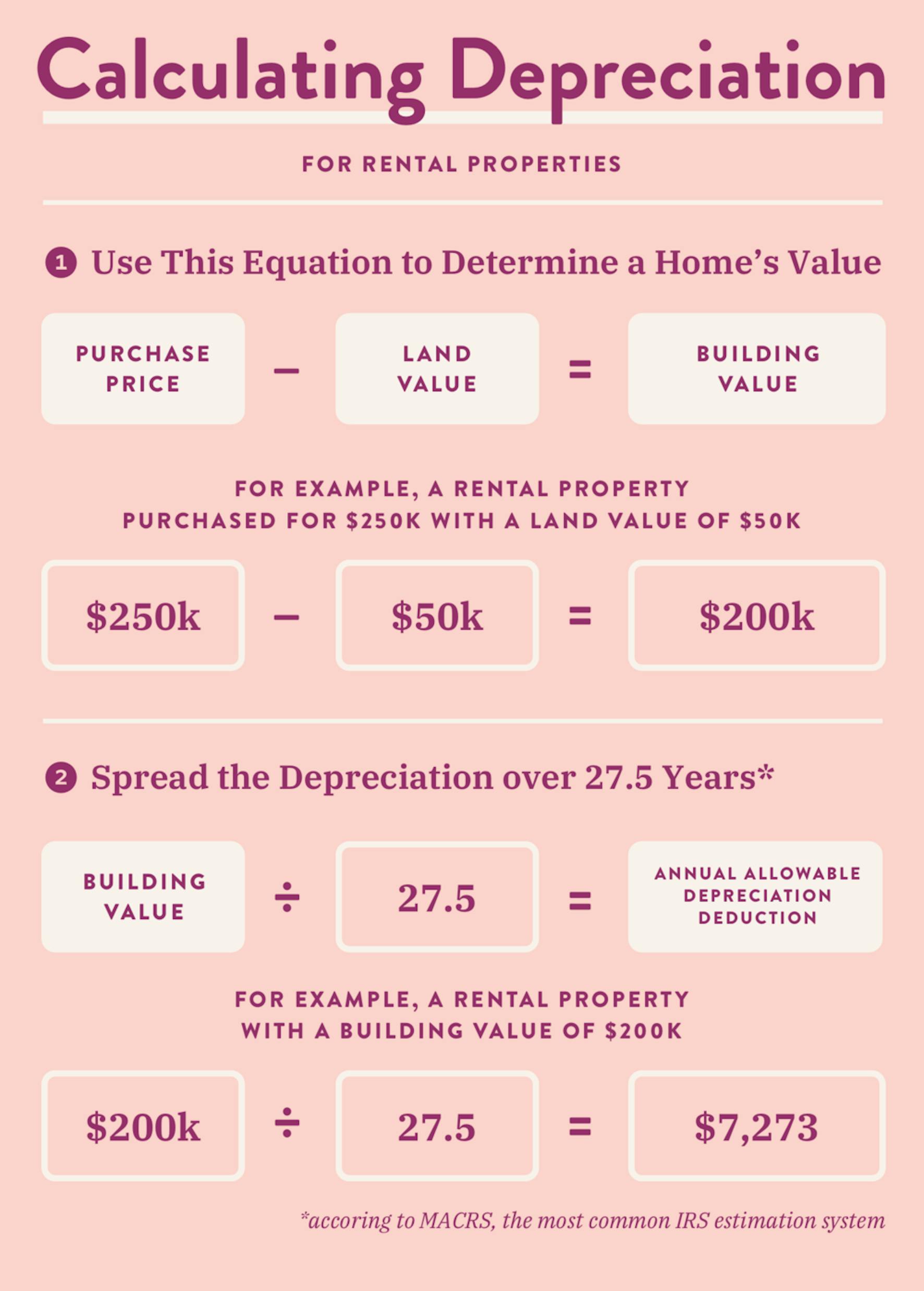

And my radical reform is get rid of real estate depreciation entirely.

The value of a real estate investment usually goes up if for no other reason than the value of the land is increasing. And the fiction of depreciation drives a lot of investments and “shelters.”

Instead, if a landlord puts on a new roof, let him or her deduct the full expense that very year. At least there then won’t be a disincentive to upkeeping a property.

Last edited:

I never really got the real estate business and just view it as inane. I know it was a main thing of deregulation, but how much was it changed by in OTL and what would happen without the inane deregulation?Yes, conflict of interest is a major, substantial problem, and it’s both Democrats and Republicans. There are some current laws about a certain window before taking a job in the same field you regulated, and I’m sure proposals for even a longer window— But I’m not sure it’s near enough.

As far as mortgage relief during a crisis, make it primary residence — as far as helping just regular homeowners and not investors — and cap it at a certain maximum tax credit, that kind of thing.

And my radical reform is get rid of real estate depreciation entirely.

The value of a real estate investment usually goes up if for no other reason than the value of the land is increasing. And the fiction of depreciation drives a lot of investments and “shelters.”

Instead, if a landlord puts on a new roof, let him or her deduct the full expense that very year. At least there then won’t be a disincentive to upkeeping a property.

@CountDVB No Financizalization change modern finances and economics as we knew it, we might never get a dotcom bubble(or a smaller one) because less unsecured loans or dumping of stocks because no push to the stock market(thank wall street and the RL wolf of wall street for that), Enron might have not overinflated itself and might have become a minor scandal in California among others stuff. But we might see slower economical cycles, Japan either doesn't get the bubble or get it worse because not easy triangularization of credits and exchange rates(i think the exchange rate accord might happen) but much of the capital bubble will be far different.

I'm sure it's not near enough. I'd start at 10 years minimum.Yes, conflict of interest is a major, substantial problem, and it’s both Democrats and Republicans. There are some current laws about a certain window before taking a job in the same field you regulated, and I’m sure proposals for even a longer window— But I’m not sure it’s near enough.

Agreed. If it's not a primary residence, IMO, you should get nothing. I'd cap based on borrower's income, I think; millionaires & billionaires don't need bailouts.As far as mortgage relief during a crisis, make it primary residence — as far as helping just regular homeowners and not investors — and cap it at a certain maximum tax credit, that kind of thing.

I'm not sure allowing the deduction to continue in perpetuity is a good idea, but over a lifespan (5yr? 10?), yeah.And my radical reform is get rid of real estate depreciation entirely.

The value of a real estate investment usually goes up if for no other reason than the value of the land is increasing. And the fiction of depreciation drives a lot of investments and “shelters.”

Instead, if a landlord puts on a new roof, let him or her deduct the full expense that very year. At least there then won’t be a disincentive to upkeeping a property.

If we're going to include broader reform than just financial, I'd add an end to the mortgage deduction, which benefits mostly the wealthy, & helps create inequality, sprawl (people want bigger houses than then can actually afford, which get built in 'burbs where taxes are lower thanks to not having to pay the full cost of installing services), pollution (sprawl puts people farther from work, so commutes are longer), & crime (tho that one I can't tell you the connection for,

I don't think deregulation affected it. I do think changing it would be a good thing.So without the wave wave deregulation, you’d think we’d get rid of NOL deductions or would they be just more restricted?

I think you could get that with just about any PotUS, of either party, without a crisis, if there's personal ideology behind it. If not, a reaction to the '82 crisis, or to the '87 market slump, could do it--or, going back farther, the '58 (?) recession.Tax reform would be interesting though wonder what could trigger it.

IDK if it would (necessarily) be a reaction. I just think it'd be a good idea, to reduce inequality & to reduce the incentive toward insanely high executive pay.I guess as the economy moves more to finance, without the insane deregulation, wed see some increase of capital gains?

IDK if it affects financialization as such, but I'd strongly advocate a stock trade tax. It'd reduce market volatility (as people buy & hold to avoid it, rather than "flip trade") & could actually increase actual investment (rather than speculation), by taxing short term trades & giving a credit to holds of (say) 5yr or more.

I reckon the dotcom bubble would still happen because new tech still tends to go through these sort of ivnestment stuff...@CountDVB No Financizalization change modern finances and economics as we knew it, we might never get a dotcom bubble(or a smaller one) because less unsecured loans or dumping of stocks because no push to the stock market(thank wall street and the RL wolf of wall street for that), Enron might have not overinflated itself and might have become a minor scandal in California among others stuff. But we might see slower economical cycles, Japan either doesn't get the bubble or get it worse because not easy triangularization of credits and exchange rates(i think the exchange rate accord might happen) but much of the capital bubble will be far different.

A quarter percent per trade should do it.IDK if it affects financialization as such, but I'd strongly advocate a stock trade tax. It'd reduce market volatility (as people buy & hold to avoid it, rather than "flip trade") & could actually increase actual investment (rather than speculation), by taxing short term trades & giving a credit to holds of (say) 5yr or more.

No Financialization meaning less insecure money on the system, meaning those nerds have to negotiate the old way...with serious companies or real investors and those will want the real product and real patents with it, meaning a smaller to no bubble because of the monetary flow dynamics. In few words, we broke Fischer equation at least for the investment marketI reckon the dotcom bubble would still happen because new tech still tends to go through these sort of ivnestment stuff...

Yeah, everyone wants to get in on the newest thing because the successful ones will go through the roof.I reckon the dotcom bubble would still happen because new tech still tends to go through these sort of ivnestment stuff...

Serious companies and real investors also get caught up in hype, I doubt it would change much. Serious companies and real investors got burned in the late 19th-early 20th century buying stock in small time auto companies that quickly went belly up. That is what happens when something is "The latest thing".No Financialization meaning less insecure money on the system, meaning those nerds have to negotiate the old way...with serious companies or real investors and those will want the real product and real patents with it, meaning a smaller to no bubble because of the monetary flow dynamics. In few words, we broke Fischer equation at least for the investment market

Yeah the winner and losers, just this one might be a smaller one, that will still be swept under the rug if a 911 event happens in the same timeframeSerious companies and real investors also get caught up in hype, I doubt it would change much. Serious companies and real investors got burned in the late 19th-early 20th century buying stock in small time auto companies that quickly went belly up. That is what happens when something is "The latest thing".

The rise of the finance sector is inevitable, by finacialization, was referring to its dominance within OTL. This would probably affect more social media and so on thoughNo Financialization meaning less insecure money on the system, meaning those nerds have to negotiate the old way...with serious companies or real investors and those will want the real product and real patents with it, meaning a smaller to no bubble because of the monetary flow dynamics. In few words, we broke Fischer equation at least for the investment market

GeographyDude

Gone Fishin'

The fact that this survey of income has been done with the same methods for 44 years, and now approaching 50 years, does give me greater confidence.That was true in 1971 as well so that should have evened out.

But all the same, because people are hoping this year will pick up, because people don’t want admit to a stranger how much things have slipped, I think it might well under-estimate the amount of slippage from middle- to lower-income. I mean, just look at the amount of political anger, especially among older white men.

GeographyDude

Gone Fishin'

A person who itemizes can deduct mortgage interest from their primary residence.. . . If we're going to include broader reform than just financial, I'd add an end to the mortgage deduction, . .

On the other hand . . .

I’m talking about depreciation of rental property such as:

So, the person can deduct $7,273 every year from their other income.

And when they sell the property at a profit — which they’ll most probably do ! ! — they’ll pay taxes at the lower capital gains rate. What a deal!

Maybe too good a deal, for this was a major contributing factor to the Savings & Loan Crisis which started around 1989 and, most importantly, the Sept. 2008 collapse of Lehman Brothers and the near-collapse of AIG.

In fact, the U.S. gov’t bailout of AIG to the tune of owning 79% of the company may have been the key linchpin step which prevented a far more serious collapse of the financial system. AIG was bailed out on Tues. Sept. 16, 2008, for $85 Billion, and another $37 Billion on Oct. 8, and an announcement on Nov. 10 that TARP would also kick in money, which ended up amounting to about $60 Billion from that. So, a bailout of AIG for about $182 Billion in total. And Yes, we certainly are talking Billion with a B.

https://www.reuters.com/article/aig-treasury-idUSL1E8K93M820120909

And this real estate depreciation is for the plain vanilla situation of a person in southern California buying a rental property in Las Vegas. Certainly not the only contributing factor to bubbles, but a major one.

The biggest contributing factor to 2008 was not gambling with the dirty mortgages themselves, but rather gambling with what was built on top — derivatives on top of derivatives, some of which seemed designed to fail and be shorted. Don’t know how that part is legal. And AIG may not be guilty of this last part, but we have them on plenty else.

Last edited:

GeographyDude

Gone Fishin'

:max_bytes(150000):strip_icc()/Bernanke_Chip_Somodevilla_Getty-57a314db5f9b589aa9d430e9.jpg)

This Bailout Made Bernanke Angrier than Anything Else in the Recession

The AIG bailout was $182 billion. But when the Treasury sold off AIG in 2012, taxpayers made a $23 billion profit.

This article is a curious mix of factual information and goody-two-shoe-ism! ! !In December 2012, the Treasury Department sold off the last of its remaining shares of AIG. In total, the government and taxpayers made a $22.7 billion profit from the AIG bailout. That's because AIG was worth a lot more in 2012 than in 2008.

Yes, it’s better than the alternative.

I’m glad we made a profit. And $23 Billion is a shit ton of money. As is the $182 Billion U.S. taxpayers invested and were at risk for.

If you had a retirement account of $182 Thousand and put it in a highly risky investment and got the original back plus $23 Thousand profit after four years, is that something to write home about ? ?

You may have detected that I have a bit of evangelical fervor on this topic. Yes, I do. At times, I even need to consciously remind myself that the fencing foil is usually more effective than is a meat cleaver.

Last edited:

Share: