You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Anglo-Saxon Social Model - The Expanded Universe

- Thread starter Rattigan

- Start date

Threadmarks

View all 167 threadmarks

Reader mode

Reader mode

Recent threadmarks

Global Ranking: Countries by Area Global Ranking: Countries by Population United States: National Rifle Association Businesses: Anglo-American plc Review: AARB, Volume LX, Issue 5 Global Ranking: Professional sports leagues by revenue Cricket: Leading women's leagues Great Men: Samuel Coleridge-TaylorDevonshire and Partners LP, usually referred to as Devonshire or more informally as Debo, is a British brand of high-end department stores, supermarkets and hotels, with operations in the Commonwealth, the United States, China and Arabia. The brand sells merchandise as part of an employee-owned mutual organisation, the second largest in the world (after its Commonwealth competitor B&Q). The partnership’s motto since 1925 has been that it is “never knowingly undersold.”

The partnership began when Lord Hartington, who had served as prime minister between 1880 and 1888, sought to maximise the use of his vast agricultural estates in the new legal regime that his government had introduced. The most notable of these were the so-called “use it or lose it” land regulations, which effectively required agricultural landlords to work with tenants to maximise profit or risk the tenants being able to purchase their land for a fixed price. To this end he formed a partnership with Wallace Waite, Peter Jones and Arthur Rose in 1890, which provided guaranteed outlets for the sale of Hartington’s tenants’ produce. Rebranding all their stores as “Devonshire and Partners” in 1920, the partnership expanded around the UK in the years before the World War.

The partnership opened its first non-British stores in Canada in 1937, expanding to Australia in 1949, Rhodesia in 1953 and, eventually, every member state of the Commonwealth. Devonshire made its first expansion outside the Commonwealth in 1968, with the acquisition of the Arabian chain Spinneys. It has since opened stores in China (starting in 1973) and the United States (from 1980), in the latter of which it trades under the “Whole Foods” name.

As well as its retail business, Devonshire and Partners also operates a chain of luxury hotels and spas. This aspect of the business began in 1959, when the 11th Duke opened may of his properties to the public. The partnership currently operates five 5-star hotels and spas in the United Kingdom (Bolton Abbey, Compton Place, Londesborough Hall, Hardwick Hall and Chiswick House), eight in Arabia (including Jerusalem’s King David Hotel), two mixed-use apartment blocks in New York City (the Dakota and the Bayard-Condict building) and the Broadway Mansions building in Shanghai. The hotels all operate under their own names and are not branded the “Devonshire” label, although workers are partners in the business in the same sense as their colleagues in the retail business.

Devonshire has been described as having an upmarket reputation, although current senior partner Lord Devonshire (the fifth generation of his family to hold the position) has argued that this is not the case when its grocery prices are compared to those of rivals such as Imtiaz or the Co-operative.

The partnership began when Lord Hartington, who had served as prime minister between 1880 and 1888, sought to maximise the use of his vast agricultural estates in the new legal regime that his government had introduced. The most notable of these were the so-called “use it or lose it” land regulations, which effectively required agricultural landlords to work with tenants to maximise profit or risk the tenants being able to purchase their land for a fixed price. To this end he formed a partnership with Wallace Waite, Peter Jones and Arthur Rose in 1890, which provided guaranteed outlets for the sale of Hartington’s tenants’ produce. Rebranding all their stores as “Devonshire and Partners” in 1920, the partnership expanded around the UK in the years before the World War.

The partnership opened its first non-British stores in Canada in 1937, expanding to Australia in 1949, Rhodesia in 1953 and, eventually, every member state of the Commonwealth. Devonshire made its first expansion outside the Commonwealth in 1968, with the acquisition of the Arabian chain Spinneys. It has since opened stores in China (starting in 1973) and the United States (from 1980), in the latter of which it trades under the “Whole Foods” name.

As well as its retail business, Devonshire and Partners also operates a chain of luxury hotels and spas. This aspect of the business began in 1959, when the 11th Duke opened may of his properties to the public. The partnership currently operates five 5-star hotels and spas in the United Kingdom (Bolton Abbey, Compton Place, Londesborough Hall, Hardwick Hall and Chiswick House), eight in Arabia (including Jerusalem’s King David Hotel), two mixed-use apartment blocks in New York City (the Dakota and the Bayard-Condict building) and the Broadway Mansions building in Shanghai. The hotels all operate under their own names and are not branded the “Devonshire” label, although workers are partners in the business in the same sense as their colleagues in the retail business.

Devonshire has been described as having an upmarket reputation, although current senior partner Lord Devonshire (the fifth generation of his family to hold the position) has argued that this is not the case when its grocery prices are compared to those of rivals such as Imtiaz or the Co-operative.

Last edited:

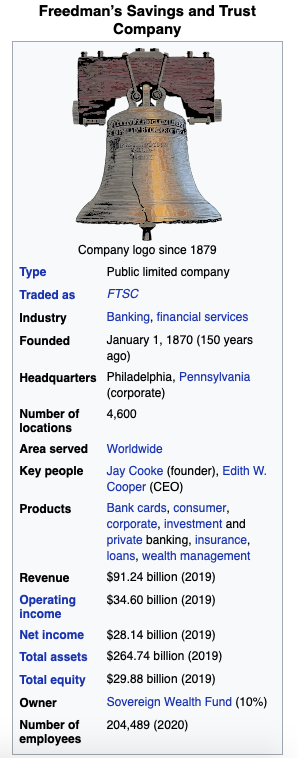

The Freedman’s Savings and Trust Company, commonly known as the Freedman’s Bank, is an American multinational bank and financial services company headquartered in Philadelphia, with central hubs in New York City, London, Shanghai, Atlanta and Los Angeles. It is the largest commercial bank in the United States, servicing approximately 27% of all American bank deposits, in direct competition with the other “Big Four” banks (Bank of America, Wells Fargo and Citicorp). The amount of assets under management in its investment banking arm is the third largest of any institution in the United States (after Merrill Lynch and Goldman Sachs) and is the ninth largest of any investment institution in the world.

The bank was chartered by the U.S. government in 1869 and began operations in 1870, with the aim of encouraging and guiding the economic development of the newly emancipated African-American communities in the post-Civil War period. Its first chairman was the Radical Republican Jay Cooke and future Vice President Frederick Douglass was a trustee until 1881. The bank expanded quickly in its early years, boasting over 70,000 depositors by 1880 and was an important lifeline for newly-enfranchised communities. The bank became very successful in the 1880s through, firstly, its financing of railroad construction and, after that ran into difficulty following the Panic of 1883, in mining.

Freedman’s Bank has historically had a close relationship with the federal government. It is, for example, the only financial institution specifically excluded from regulations requiring the separation of investment and commercial banking operations. Despite this, the Sovereign Wealth Fund of the United Kingdom was controversially allowed to take a 10% ownership stake in the bank in June 2020. The bank retains large market shares in both investment and commercial offerings. The investment arm is considered one of the bulge bracket banks and its clients include some of the largest corporations and institutions in the United States and abroad, including foreign governments. Its wealth management division is the second largest such institution in the world. In commercial banking, Freedman’s Bank maintains retail branches in all 47 states of the United States and operates (without necessarily maintaining retail branches) in more than 40 other countries. It has over 46,000,000 depositors.

The bank was chartered by the U.S. government in 1869 and began operations in 1870, with the aim of encouraging and guiding the economic development of the newly emancipated African-American communities in the post-Civil War period. Its first chairman was the Radical Republican Jay Cooke and future Vice President Frederick Douglass was a trustee until 1881. The bank expanded quickly in its early years, boasting over 70,000 depositors by 1880 and was an important lifeline for newly-enfranchised communities. The bank became very successful in the 1880s through, firstly, its financing of railroad construction and, after that ran into difficulty following the Panic of 1883, in mining.

Freedman’s Bank has historically had a close relationship with the federal government. It is, for example, the only financial institution specifically excluded from regulations requiring the separation of investment and commercial banking operations. Despite this, the Sovereign Wealth Fund of the United Kingdom was controversially allowed to take a 10% ownership stake in the bank in June 2020. The bank retains large market shares in both investment and commercial offerings. The investment arm is considered one of the bulge bracket banks and its clients include some of the largest corporations and institutions in the United States and abroad, including foreign governments. Its wealth management division is the second largest such institution in the world. In commercial banking, Freedman’s Bank maintains retail branches in all 47 states of the United States and operates (without necessarily maintaining retail branches) in more than 40 other countries. It has over 46,000,000 depositors.

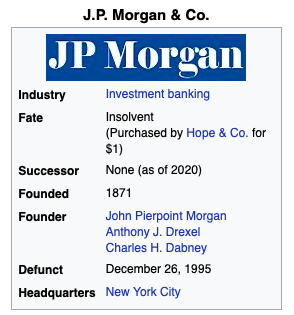

J.P. Morgan & Co. was an American investment bank founded by John Pierpoint Morgan, Anthony J. Drexel and Charles H. Dabney in 1871. It was a significant player in international banking markets during the 19th and 20th centuries until its collapse in 1995.

Originally founded as “Drexel, Morgan & Co.,” the company used its founders’ connections to bring British financial capital together with American railroads and steel, among other industries, who were in need of financial capital in the post-Civil War period. Pierpoint Morgan took over his father’s businesses in 1890 and, on Drexel’s death five years later, amalgamated them into “J.P. Morgan & Co.,” the name it would have until its collapse.

The bank played a prominent role in financing the Allied war effort in the Great War. Jack Morgan Jr., son of the founder, led a major delegation of French and American private and central bankers in September 1914 to gain financing from a consortium of British banks. The company’s interest in the steel industry also paid dividends, with it reaping the benefits of increasing armaments manufacturing. After the war, the bank was active in promoting banks in Latin America and in managing the reparations payments of the defeated Central Powers.

During this time, J.P. Morgan became well known for its innovative efforts in underwriting but this eventually got the firm into serious trouble through overexposure to investments caught up in the Paulet Scandal. When investigations into the collapse of the Paulet Group in London and New York resulted in dramatic stock market crashes on both exchanges in April 1930, J.P. Morgan’s vulnerability was exposed as they lacked sufficient reserves to support their various (now failing) investments. Through the organisational skills of the Governor of the Bank of the United States, Waddill Catchings, a consortium of banks was arranged to bail out J.P. Morgan and support a restructuring.

Although the rescue avoided a global collapse of the firm, J.P. Morgan still struggled through the rest of the decade. Morgan Jr. lost his personal fortune, which was pledged to support the bank, although he did live to recover the chairmanship when the bank paid off its debts in 1941. In this year, the company returned to issuance on a substantial scale, this time concentrating on securities in the United States. Its new, restrained policy, under the leadership of Henry Sturgis Morgan, created stability but also cost the bank its position at the high table of international finance, overtaken by British banks such as Barings, Warburg and Schroders, as well as American competitors such as Merrill Lynch, Goldman Sachs and Freedman’s. However, the bank remained an important player in American and international markets until 1995.

In this year, J.P. Morgan was brought down by a massive loss caused by fraudulent accounting by the Chief Financial Officer of its Hong Kong office, Andrew Fastow. Circumventing normal procedures, the bank had left Fastow in a position where he was able to settle his own trades while also having wide discretion over where to sell assets. Fastow was then able to design a complex web of special purpose corporate vehicles that were, although notionally independent, in practice controlled by Fastow and solely did business with J.P. Morgan’s Hong Kong office. This effectively allowed Fastow to hide his massive losses and move failing assets off his balance sheet, making his office’s asset and liability sheet appear healthy whereas it was in fact making losses approaching $30 billion.

Fastow’s luck ran out following the Kobe earthquake in January 1995. Despite the natural disaster causing economic recessions around Asia, J.P. Morgan’s balance sheet continued to look healthy, leading many to conclude that problems were being hidden. Some investors began shorting J.P. Morgan stock as early as April. In October 1995, a disgruntled former executive at J.P. Morgan leaked a copy of the offering memorandum for one of Fastow’s partnerships to the newspapers, revealing his conflict of interest. On a conference call with directors in November, Fastow admitted to hiding $45 million of losses through the partnership and was told to return to New York while outside auditors were brought in. Instead of returning, Fastow absconded, confessing to the true scale of his losses in a letter to the New York office.

After a failed bailout attempt, J.P. Morgan was declared insolvent on 26 December. Fastow was picked up by police in Kampala and sentenced to six years in jail in Hong Kong for fraud. The internal auditing and risk management practices of the bank was also severely criticised. Fastow’s freedom to circumvent usual accounting rules through the creation of his special purpose vehicles had taken place in an atmosphere of deliberate negligence which had eventually imperiled the entire bank. The group-CFO at the time of the collapse, Michael Bloomberg, was banned for life from working in the finance industry following a high profile court case in 1999.

Benelux bank Hope & Co. purchased the name and remaining assets in November 1996 for the nominal sum of $1. As of 2020, no organization currently uses the name. The desk thought to have been in Fastow’s office while he was working in Hong Kong was sold at auction for $16,750 in 2007.

Originally founded as “Drexel, Morgan & Co.,” the company used its founders’ connections to bring British financial capital together with American railroads and steel, among other industries, who were in need of financial capital in the post-Civil War period. Pierpoint Morgan took over his father’s businesses in 1890 and, on Drexel’s death five years later, amalgamated them into “J.P. Morgan & Co.,” the name it would have until its collapse.

The bank played a prominent role in financing the Allied war effort in the Great War. Jack Morgan Jr., son of the founder, led a major delegation of French and American private and central bankers in September 1914 to gain financing from a consortium of British banks. The company’s interest in the steel industry also paid dividends, with it reaping the benefits of increasing armaments manufacturing. After the war, the bank was active in promoting banks in Latin America and in managing the reparations payments of the defeated Central Powers.

During this time, J.P. Morgan became well known for its innovative efforts in underwriting but this eventually got the firm into serious trouble through overexposure to investments caught up in the Paulet Scandal. When investigations into the collapse of the Paulet Group in London and New York resulted in dramatic stock market crashes on both exchanges in April 1930, J.P. Morgan’s vulnerability was exposed as they lacked sufficient reserves to support their various (now failing) investments. Through the organisational skills of the Governor of the Bank of the United States, Waddill Catchings, a consortium of banks was arranged to bail out J.P. Morgan and support a restructuring.

Although the rescue avoided a global collapse of the firm, J.P. Morgan still struggled through the rest of the decade. Morgan Jr. lost his personal fortune, which was pledged to support the bank, although he did live to recover the chairmanship when the bank paid off its debts in 1941. In this year, the company returned to issuance on a substantial scale, this time concentrating on securities in the United States. Its new, restrained policy, under the leadership of Henry Sturgis Morgan, created stability but also cost the bank its position at the high table of international finance, overtaken by British banks such as Barings, Warburg and Schroders, as well as American competitors such as Merrill Lynch, Goldman Sachs and Freedman’s. However, the bank remained an important player in American and international markets until 1995.

In this year, J.P. Morgan was brought down by a massive loss caused by fraudulent accounting by the Chief Financial Officer of its Hong Kong office, Andrew Fastow. Circumventing normal procedures, the bank had left Fastow in a position where he was able to settle his own trades while also having wide discretion over where to sell assets. Fastow was then able to design a complex web of special purpose corporate vehicles that were, although notionally independent, in practice controlled by Fastow and solely did business with J.P. Morgan’s Hong Kong office. This effectively allowed Fastow to hide his massive losses and move failing assets off his balance sheet, making his office’s asset and liability sheet appear healthy whereas it was in fact making losses approaching $30 billion.

Fastow’s luck ran out following the Kobe earthquake in January 1995. Despite the natural disaster causing economic recessions around Asia, J.P. Morgan’s balance sheet continued to look healthy, leading many to conclude that problems were being hidden. Some investors began shorting J.P. Morgan stock as early as April. In October 1995, a disgruntled former executive at J.P. Morgan leaked a copy of the offering memorandum for one of Fastow’s partnerships to the newspapers, revealing his conflict of interest. On a conference call with directors in November, Fastow admitted to hiding $45 million of losses through the partnership and was told to return to New York while outside auditors were brought in. Instead of returning, Fastow absconded, confessing to the true scale of his losses in a letter to the New York office.

After a failed bailout attempt, J.P. Morgan was declared insolvent on 26 December. Fastow was picked up by police in Kampala and sentenced to six years in jail in Hong Kong for fraud. The internal auditing and risk management practices of the bank was also severely criticised. Fastow’s freedom to circumvent usual accounting rules through the creation of his special purpose vehicles had taken place in an atmosphere of deliberate negligence which had eventually imperiled the entire bank. The group-CFO at the time of the collapse, Michael Bloomberg, was banned for life from working in the finance industry following a high profile court case in 1999.

Benelux bank Hope & Co. purchased the name and remaining assets in November 1996 for the nominal sum of $1. As of 2020, no organization currently uses the name. The desk thought to have been in Fastow’s office while he was working in Hong Kong was sold at auction for $16,750 in 2007.

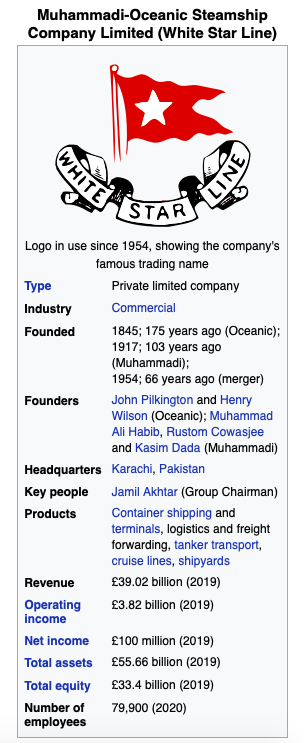

The Muhammadi-Oceanic Steamship Company Limited, more commonly known by its trading name the White Star Line, is an Anglo-Pakistani shipping company operating both cruise lines and container shipping, as well as substantial shipbuilding operations.

Muhammadi-Oceanic was formed in 1954 by the merger of the British company Oceanic Steam Navigation and the Pakistani company Muhammadi Steamships. During the Edwardian period, Oceanic became famous for its innovations in passenger ship design, notably ships such as RMS Oceanic I (1870), RMS Titanic (1912) and RMS Oceanic II (1936), as well as its emphasis on reliable and comfortable passages for upper class and migrant travellers. The company was prominent in international shipping markets into the 20th century but it entered a prolonged decline after 1930. It launched the Oceanic II in 1936 but only thanks to substantial investment from the “People’s Home” government programs. During the World War, a large number of Oceanic ships, including the Titanic and the RMS Laurentic, were sunk by Axis submarines and the company entered the postwar period with a skeleton fleet and at a severe disadvantage against its rivals.

Muhammadi was founded in 1917 and found success in the commercial shipping field out of the expanding Port of Karachi. Following Pakistani independence in 1948, the company became a national champion and was able to gain access to preferential loans from the Pakistani and British government to complete the purchase of the troubled Oceanic line in 1954. The additional equity provided by the healthier commercial shipping business allowed Muhammadi-Oceanic to successfully draw down its year-round trans-Atlantic passenger service over the course of the 1960s in order to concentrate on cruising and summer voyages for vacationers. Meanwhile, the commercial shipping branch of the company flourished further following the advent of container shipping.

As of 2020, Muhammadi-Oceanic is the largest shipbuilding and shipping container company in the world by revenue, fleet size and cargo capacity. Its main shipyard is in Karachi but it operates a network of smaller shipyards around the Commonwealth, notably in Colombo, Birkenhead and Dar es Salaam. Its container fleet consists of over 400 cargo vessels including the Elizabeth-class, the largest container ships ever constructed. The company’s passenger fleet currently consists of three liners, all of the Albion-class. The company’s headquarters are in Muhammadi House in Karachi.

Muhammadi-Oceanic was formed in 1954 by the merger of the British company Oceanic Steam Navigation and the Pakistani company Muhammadi Steamships. During the Edwardian period, Oceanic became famous for its innovations in passenger ship design, notably ships such as RMS Oceanic I (1870), RMS Titanic (1912) and RMS Oceanic II (1936), as well as its emphasis on reliable and comfortable passages for upper class and migrant travellers. The company was prominent in international shipping markets into the 20th century but it entered a prolonged decline after 1930. It launched the Oceanic II in 1936 but only thanks to substantial investment from the “People’s Home” government programs. During the World War, a large number of Oceanic ships, including the Titanic and the RMS Laurentic, were sunk by Axis submarines and the company entered the postwar period with a skeleton fleet and at a severe disadvantage against its rivals.

Muhammadi was founded in 1917 and found success in the commercial shipping field out of the expanding Port of Karachi. Following Pakistani independence in 1948, the company became a national champion and was able to gain access to preferential loans from the Pakistani and British government to complete the purchase of the troubled Oceanic line in 1954. The additional equity provided by the healthier commercial shipping business allowed Muhammadi-Oceanic to successfully draw down its year-round trans-Atlantic passenger service over the course of the 1960s in order to concentrate on cruising and summer voyages for vacationers. Meanwhile, the commercial shipping branch of the company flourished further following the advent of container shipping.

As of 2020, Muhammadi-Oceanic is the largest shipbuilding and shipping container company in the world by revenue, fleet size and cargo capacity. Its main shipyard is in Karachi but it operates a network of smaller shipyards around the Commonwealth, notably in Colombo, Birkenhead and Dar es Salaam. Its container fleet consists of over 400 cargo vessels including the Elizabeth-class, the largest container ships ever constructed. The company’s passenger fleet currently consists of three liners, all of the Albion-class. The company’s headquarters are in Muhammadi House in Karachi.

Last edited:

Threadmarks

View all 167 threadmarks

Reader mode

Reader mode

Recent threadmarks

Global Ranking: Countries by Area Global Ranking: Countries by Population United States: National Rifle Association Businesses: Anglo-American plc Review: AARB, Volume LX, Issue 5 Global Ranking: Professional sports leagues by revenue Cricket: Leading women's leagues Great Men: Samuel Coleridge-Taylor

Share: